Airdrop Guide — Timeswap

Update: They have launched their mainnet at https://app.timeswap.io/. Try it out!

Follow us to receive the latest airdrop and whitelist updates.

Twitter: https://twitter.com/CalendarDefi

Telegram channel: https://t.me/deficalendar

Timeswap is an AMM based lending protocol. It works without oracles or liquidators, making it safe from oracle attacks. You can find more details on how Timeswap works here.

They recently raised their seed round led by Multicoin Capital.

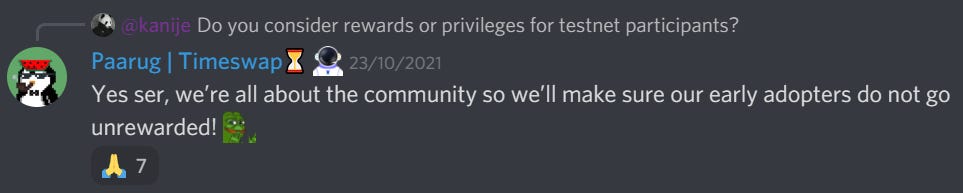

They are now inviting users to try out their testnet. Messages from the Timeswap team at their discord server suggest there will be some form of rewards for testnet participants.

They are now inviting users to try out their testnet. Messages from the Timeswap team at their discord server suggest there will be some form of rewards for testnet participants.

Let’s go through different functions of the Timeswap testnet.

Getting started:

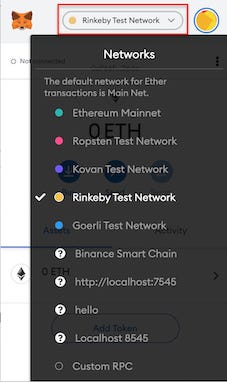

First you will need to connect to Rinkeby testnet from your wallet. To tune into Rinkeby, click on the network switch button at the top of the Metamask and select Rinkeby Test Network.

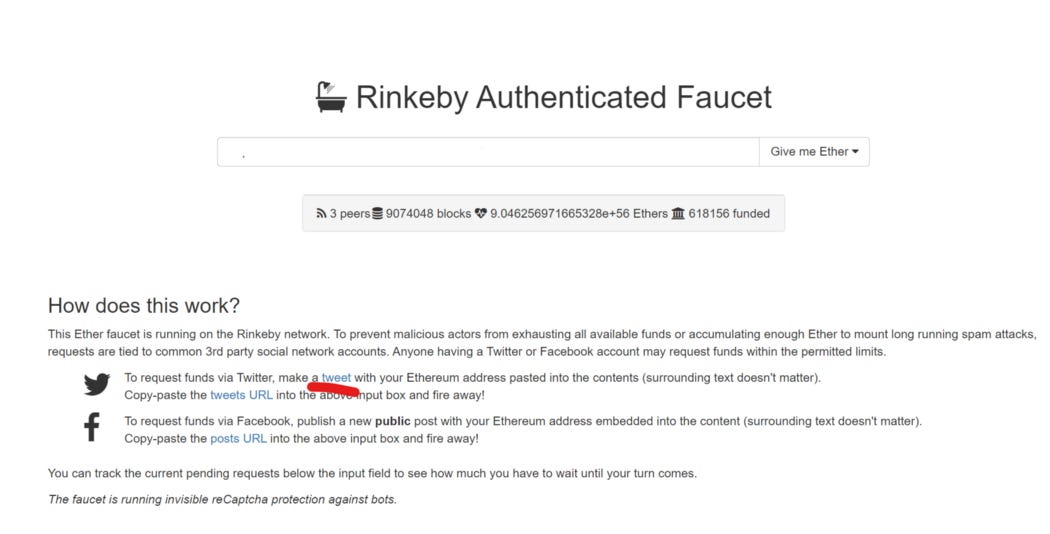

The next step is to obtain test ETH to use on the Rinkeby Test Network.

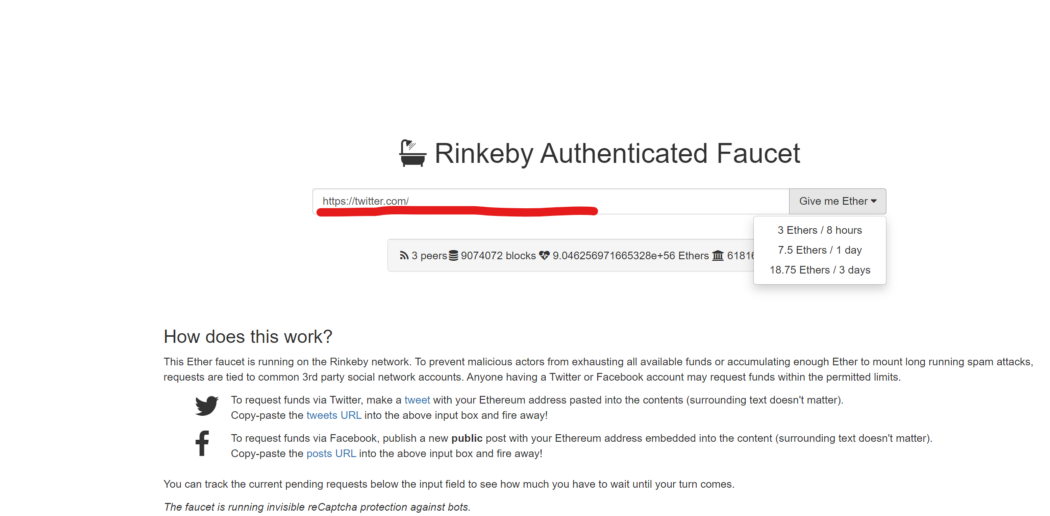

You can obtain test ETH from https://faucet.rinkeby.io/. Click on the tweet link in the page.

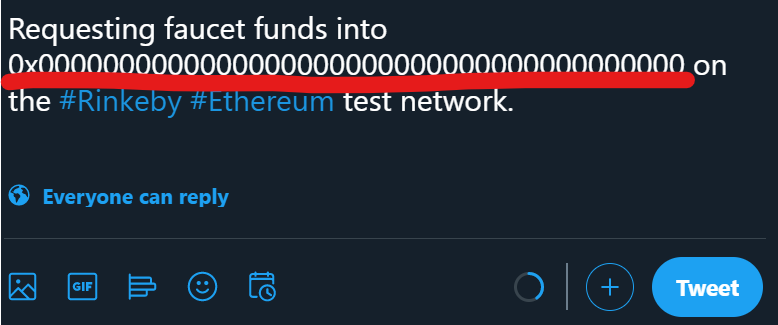

Before posting, you need to change ”0x0000000000000000000000000000000000000000" to your ETH address.

Copy the tweets URL and paste it into the input box on Rinkeby Faucet. Select the amount of ETH you need from the ‘Give me Ether’ button.

Step 1:

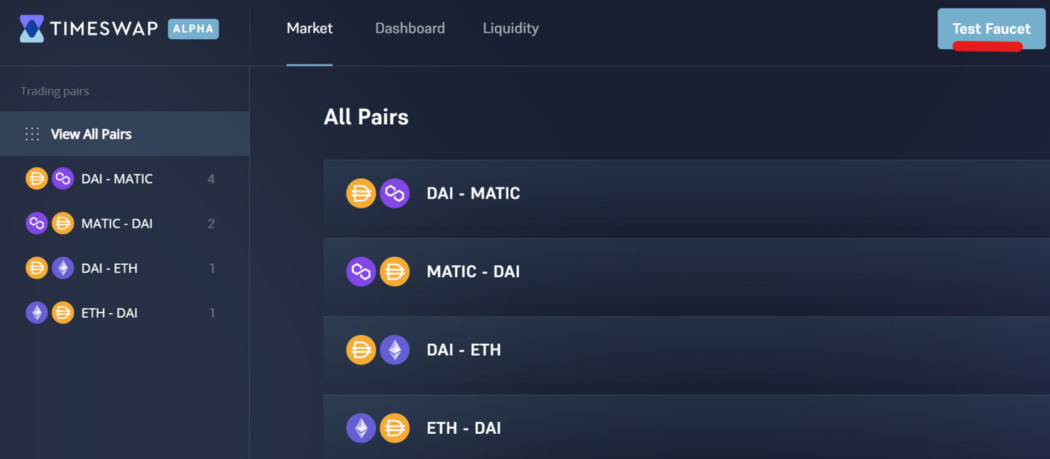

We first get some testnet tokens. Head to https://app.timeswap.io/ and click on “Test Faucet” to get your $DAI and $MATIC.

Step 2:

We try the lending function.

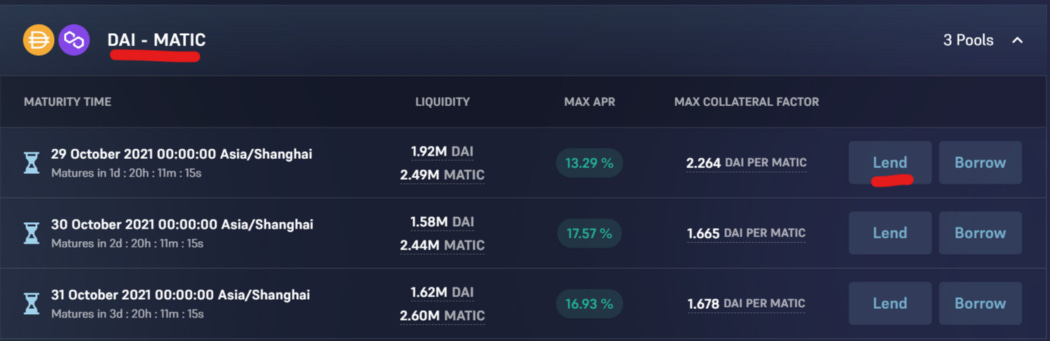

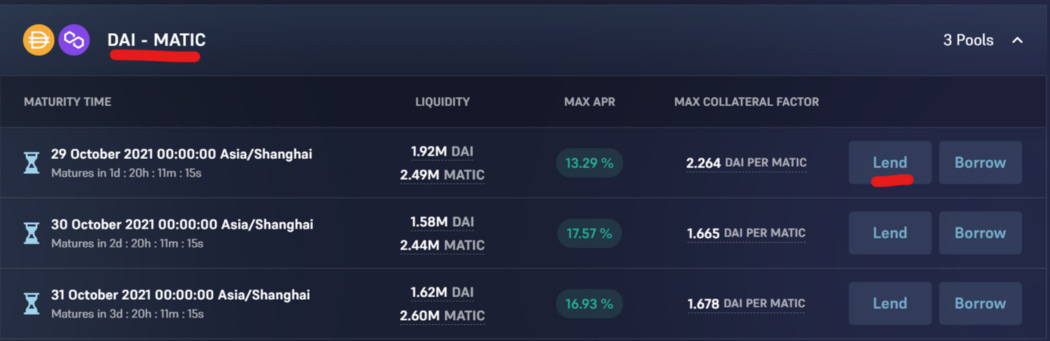

Choose an asset pair and the loan maturity date. Click “Lend”. (You will be lending out $DAI here and receive $MATIC in case of default.)

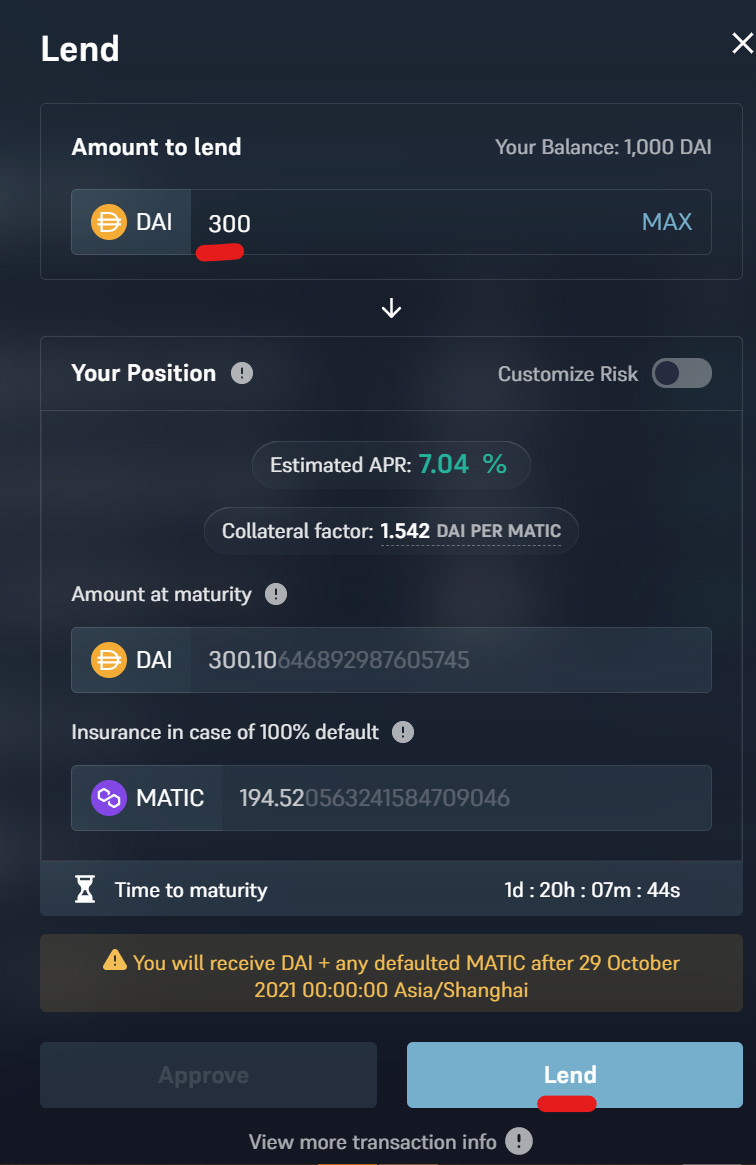

We first do a standard lending. Input your amount to lend and click “Lend”.

Click on “Lend” again.

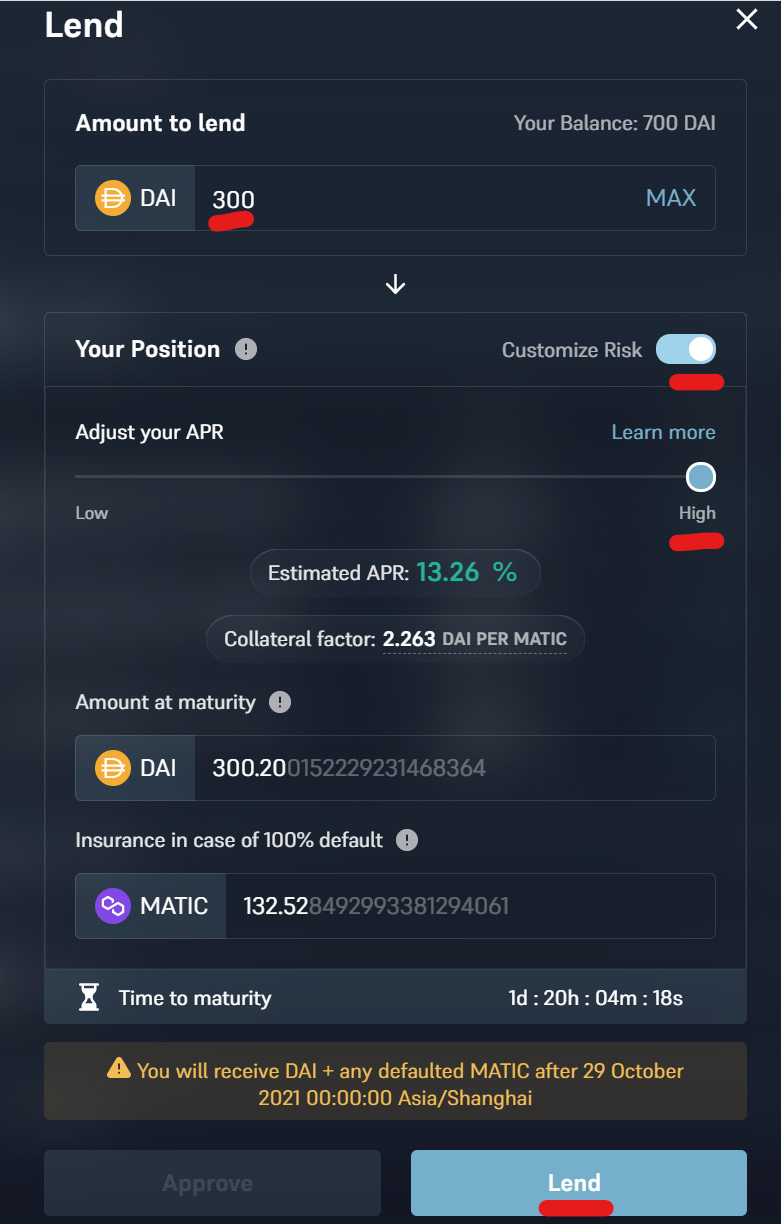

Input your amount to lend. This time move the slider at “Customize Risk”. You will then be able to adjust your APR. Confirm your transaction.

(The higher the APR, the higher is the expected amount at maturity and lower the insurance coverage, and vice-versa.)

Step 3: (To be completed after your loan matures)

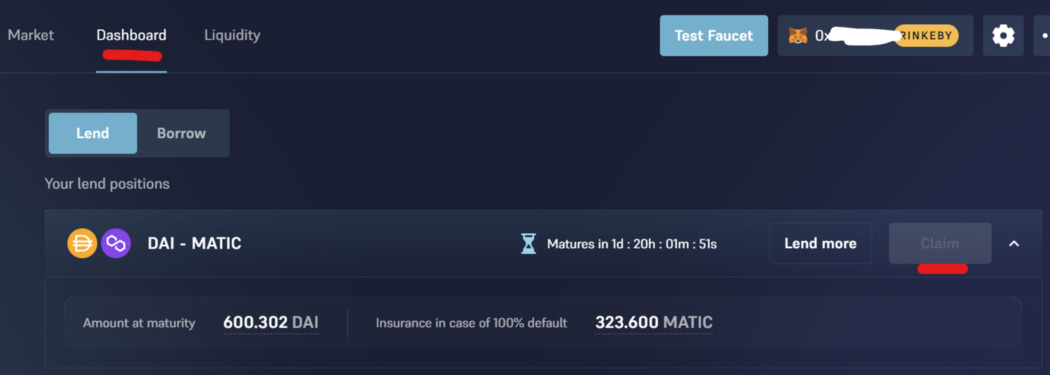

Remember to claim your assets (the principal and the interest earned) after your loan matures at “Dashboard”.

Step 4:

We proceed to borrow.

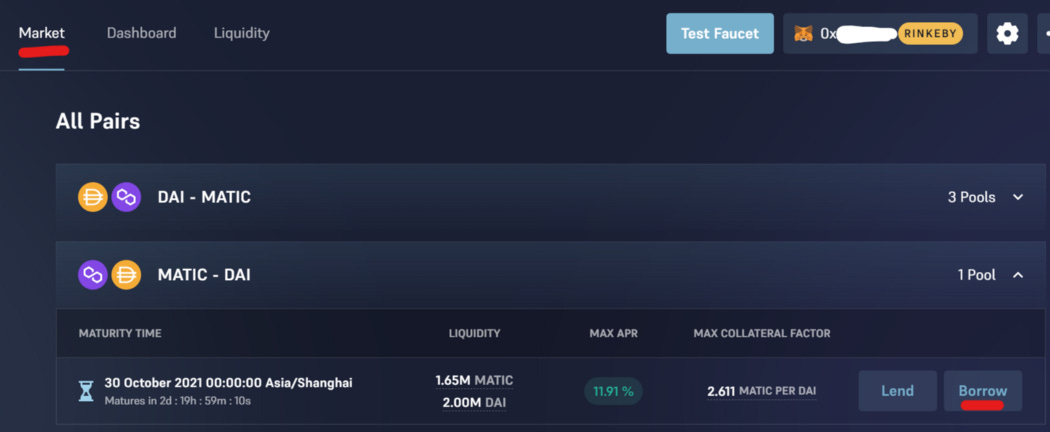

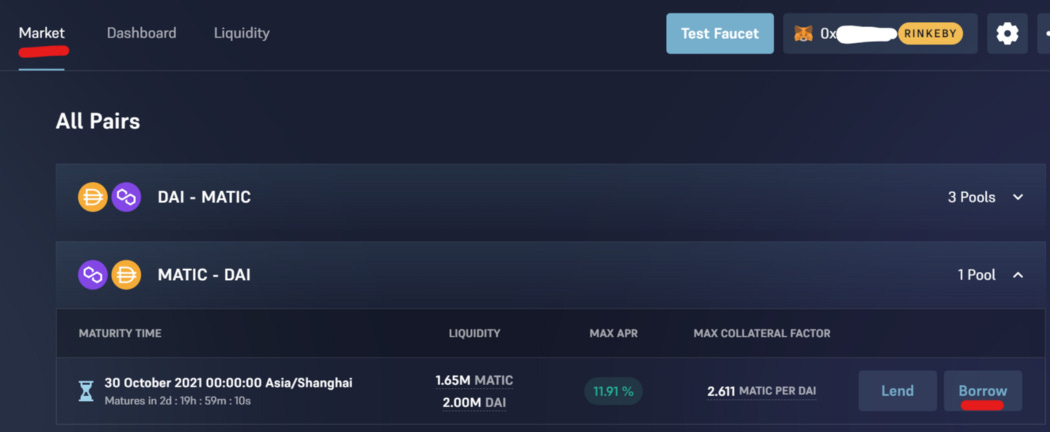

Go back to “Market” and choose another asset pair. Click “Borrow”.

Again we do a standard borrowing first. Input your amount and confirm.

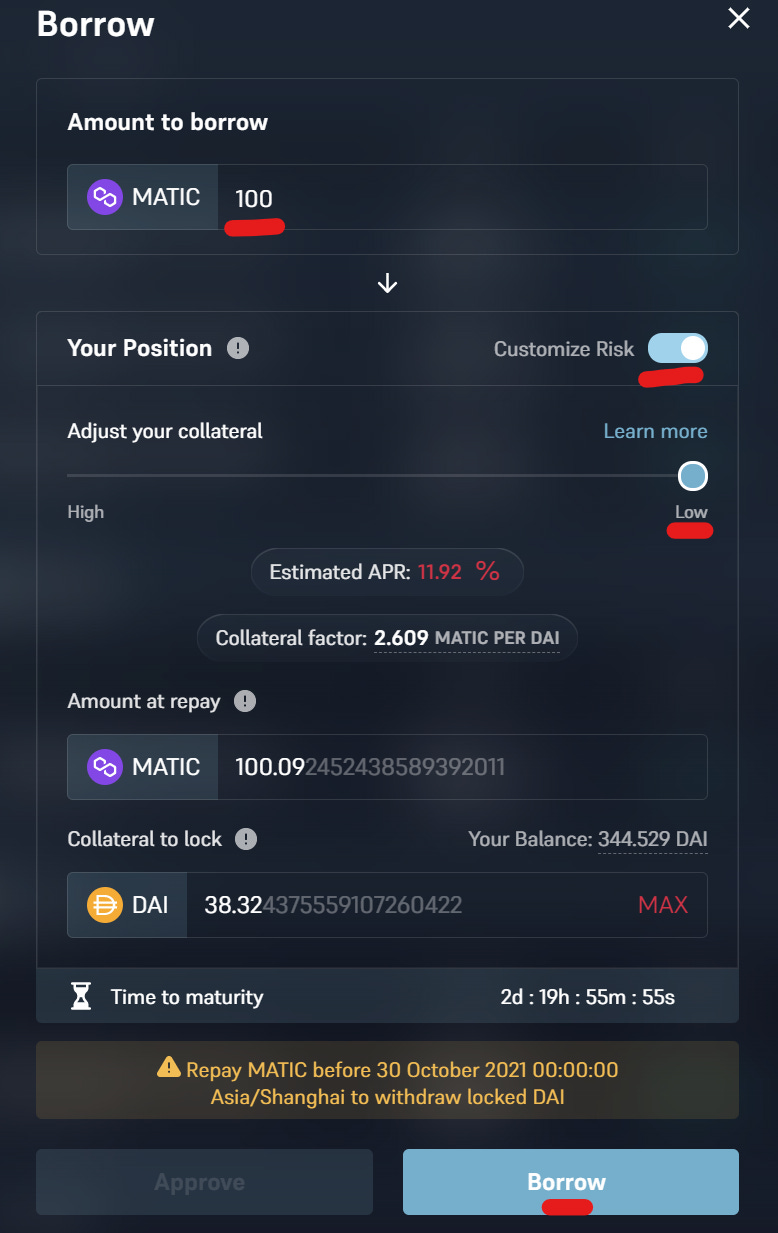

Click on “Borrow” again.

Then move the slider at “Customize risk” and adjust your collateral level. Confirm your transaction.

(The lower the collateral you wish to lock, the higher is the estimated APR, and vice-versa.)

Step 5:

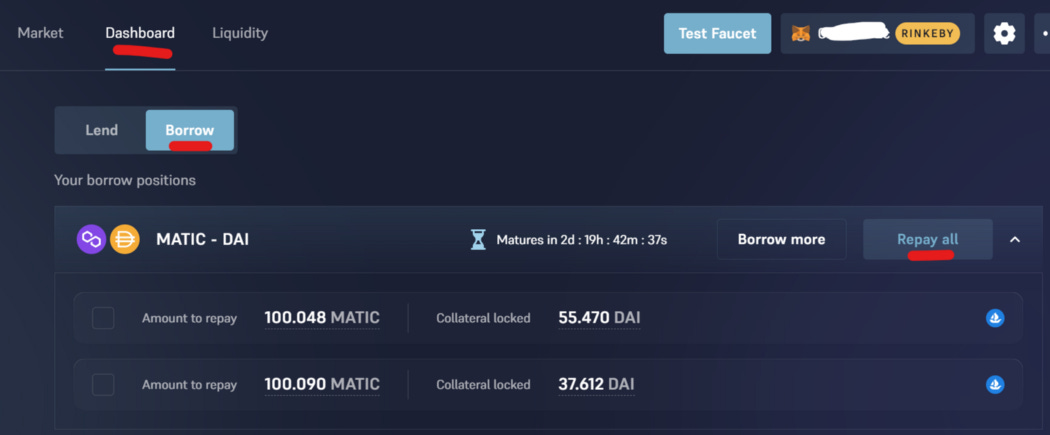

Finally we repay our loans.

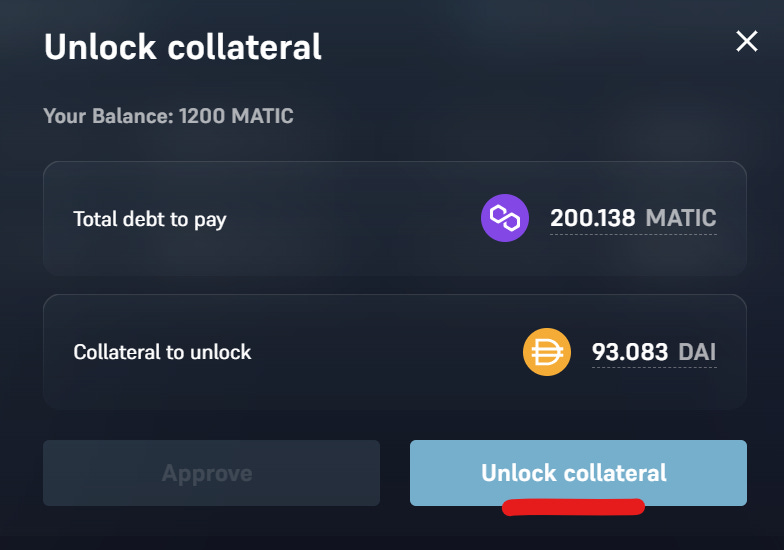

Go to “Dashboard” and choose “Borrow”. Click on “Repay all” and “Unlock collateral”. (Your transaction might fail the first time. Try again and it should work.)

Step 6:

That’s all guys. If you find any bugs or have any feedbacks, please share with the Timeswap team at their discord server.

awesome project, can't wait for the live process. thanks guys

saying theres 0 pools available