Mainnet Guide - Arbitrum Ecosystem

Our new profile page: https://link3.to/deficalendar

Check the status of previous airdrops https://docs.google.com/spreadsheets/d/1agcpqrYDJg0cX12jC7nrtrbC20aZxweub0M6fBUVPUI/edit?usp=sharing.

TLDR: Arbitrum Mainnet, Potential Airdrop

Introduction

Arbitrum (Twitter : https://twitter.com/arbitrum) is an Ethereum Layer 2 scaling solution.

Rules

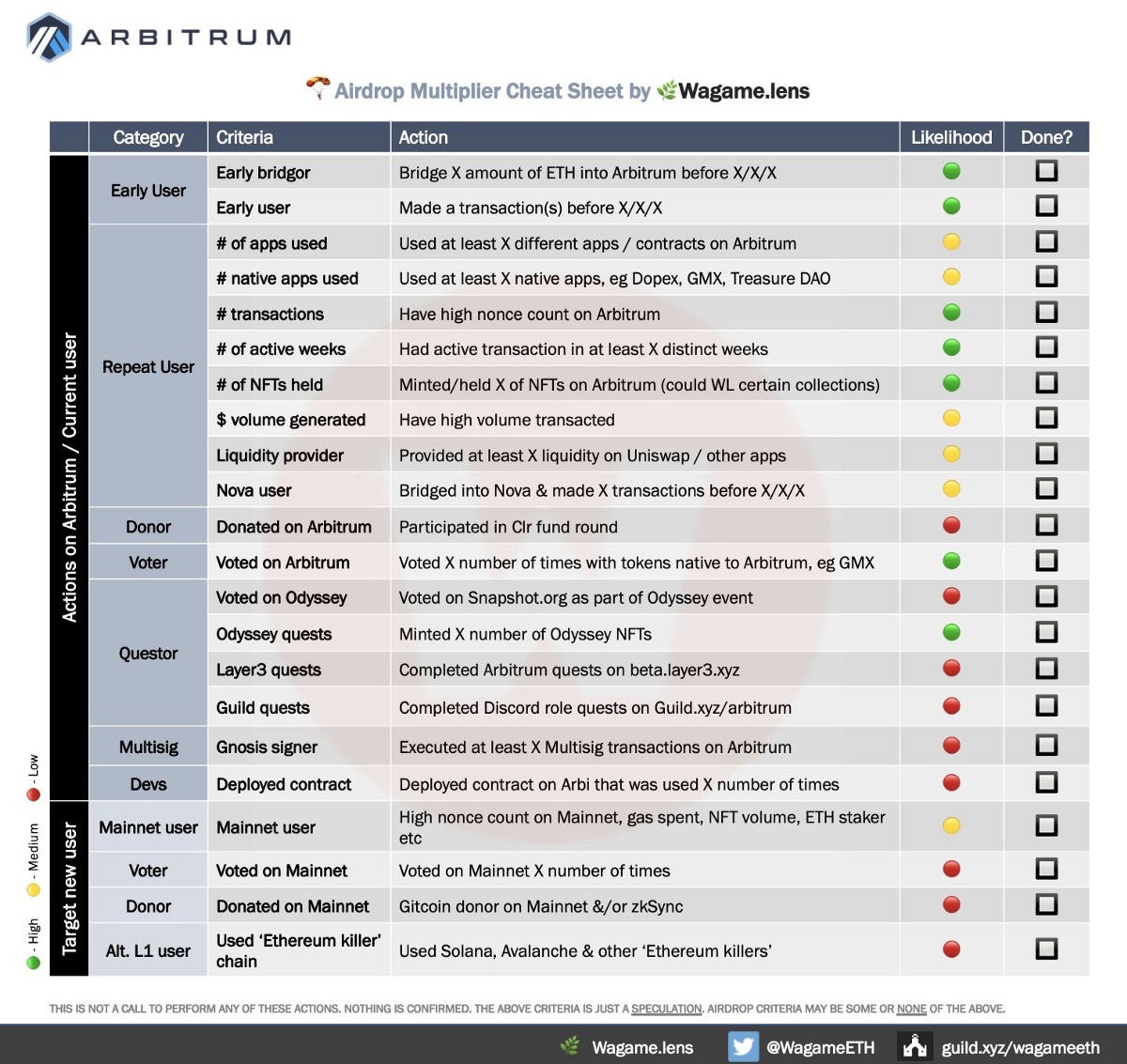

Recently there’s been a lot of speculation about the $ARBI token airdrop. For example, wagame.eth has produced a cheat sheet for different possible criteria.

The consensus seems to be that on-chain activity will be the most important criteria for the airdrop distribution.

Therefore we brought you a few projects on Arbitrum that don’t have a token. Interact with them for a chance to receive $ARBI airdrop as well as the project token airdrop.

Guide

Getting Started:

If you don’t have the Arbitrum network on your MetaMask, go add it at https://chainlist.org/

Step 1:

You’ll have to bridge over some $ETH to Arbitrum. You can use Rango (confirmed airdrop)/Meson (free bridging for stablecoins)/Bungee (no token) to do the bridging from other Layer 2s such as Polygon.

Step 2:

We can then interacting with different protocols in Arbitrum.

Here are some high potential protocols on Arbitrum without tokens. Interact with the ones you like.

Nested (Twitter: https://twitter.com/NestedFi)

https://app.nested.fi/explorer/arbi:536/3q6r (Copy this USDC portfolio or create a new one yourself.)

Confirmed airdrop (for portfolios >$20). Social investing tool on Arbitrum. We previously covered it on other chains in this article.

VoVo (Twitter: https://twitter.com/VovoFinance)

First structured products protocol on Arbitrum. Deposit USDC or GLP.

Vovo farms with your stablecoins on Curve and use the yield to open leveraged long/short positions on GMX.

Rage Trade (Twitter: https://twitter.com/rage_trade)

https://www.app.rage.trade/vaults/

Deposit USDC/ETH/Curve tricrypto LP tokens into their 80–20 vault to earn $CRV rewards, Curve trading fees and perp trading fees.

Sentiment (Twitter: https://twitter.com/sentimentxyz)

https://arbitrum.sentiment.xyz/lending

Deposit USDC/USDT. Undercollateralized borrowing made possible by restricting borrowed funds in their smart contract wallet.